AudNzd A Technical Combination! ~ paid forex trading signals

In the last update on Audnzd I used different technical analysis, headed by the elliot wave theory, to forecast a probable upward move.

There was a condition for a bullish opportunity.

It should be noted that the terminative pattern shown above is an ending diagonal which, according to elliot wave theory, occurs at wave 5 of an impulse or wave C of a corrective pattern.

The long term bias is still bullish but a dip could happen in a few coming days before the bullish journey continues and here are the reasons

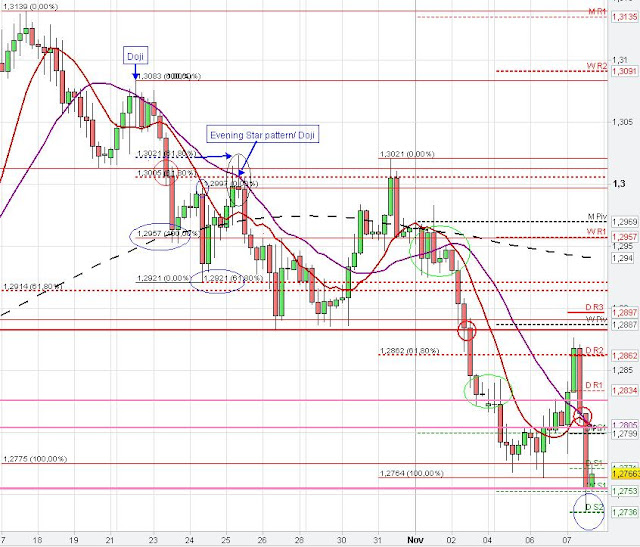

1. The breakout move from the ending diagonal is expected to be a motive 5-wave. Price chart below shows that wave (1) of this 5-wave is probably completed (at a resistance level) and price could dip (wave 2) before the big move.

2. There is a bearish candlestick pattern on the daily chart which indicates a possible weakness of the intra day bullish trend.

We have closed a large portion of our bullish position as we await the dip for more opportunity upside.

Check here for updates regularly.

You can also subscribe to our free or premium signal service by sending your e-mail address and phone number with the title "Signals" to forexmaster05@yahoo.com

There was a condition for a bullish opportunity.

Price could trace down a bit before rallying to break the upper trendline upside. This will be a trading opportunity to buy this pair with a good risk/reward ratio.There could be a trading opportunity to ride wave C to 1.2175

Read the full analysisAfter some days, price fulfilled the condition perfectly and hence, a bullish opportunity. Price broke out of the trendline with a a good bullish candle and a fast rally followed to the next resistance.

It should be noted that the terminative pattern shown above is an ending diagonal which, according to elliot wave theory, occurs at wave 5 of an impulse or wave C of a corrective pattern.

The long term bias is still bullish but a dip could happen in a few coming days before the bullish journey continues and here are the reasons

1. The breakout move from the ending diagonal is expected to be a motive 5-wave. Price chart below shows that wave (1) of this 5-wave is probably completed (at a resistance level) and price could dip (wave 2) before the big move.

2. There is a bearish candlestick pattern on the daily chart which indicates a possible weakness of the intra day bullish trend.

We have closed a large portion of our bullish position as we await the dip for more opportunity upside.

Check here for updates regularly.

You can also subscribe to our free or premium signal service by sending your e-mail address and phone number with the title "Signals" to forexmaster05@yahoo.com

More info for AudNzd A Technical Combination! ~ paid forex trading signals: