Trendline Break Confirmation

Understanding price Breakouts

|

Daily 10 Moving Average SMA

|

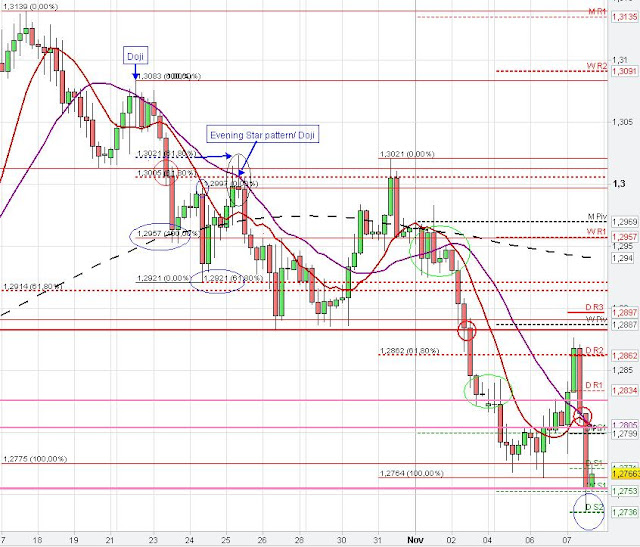

On the daily chart (left) we see that EUR/USD found resistance at the 10 SMA and monthly S2 so that in the following price dropped down.

|

| 1 hour Technical Chart Analysis Forex |

SMA Trading

On the hourly chart analysis above we see that the 200 SMA also provided resistance in the same area like the daily 10 SMA. EUR/USD only made a slightly higher high yesterday at about 1.2825 (stop fishing) whereby the 5 min breakout candle at 8.50 p.m. did not get confirmed due to the missing close of the succeeding 5 min candles above the high of the breakout candle (not shown).

EUR/USD dropped down from this high (point

A) and found temporary support at the 20 SMA (purple line) and the prior consolidation price zone at point

B. In the European session market broke through the 20 SMA and touched/ respected the red trendline with the 9 a.m..hourly candle (red circle). With the beginning of the next hourly candle (10 a.m.) market immediately broke through the now weaker (after the hourly touch-

Timing) trendline-support at 10 a.m. after the small consolidation (see 5 min chart analysis) finished with the start of the new hourly candle (10 a.m.).

In the following, EUR/USD formed a 3-wave consolidation (green circle on hourly chart analysis) at the 20 SMA on the 4-hour chart (not shown), daily S1 and the 161% fib extension from

A-B at C (hourly) at about 1.2739 and the 61.80 % fib extension from

A-B at C (5 min chart analysis) before price broke through it with the developing of the new 4 hour candle at 4.p.m (not shown). EUR/USD went down to the next support level at the 61 % fib retracement at 1.2712 and the 100 % fib extension from

C-D at E (hourly chart analysis) where price currently consolidates.

|

5 min technical chart analysis forex euro

|

3-wave consolidation

On the 5 min chart analysis above we see that the recent 3-wave consolidation

(DEF) (green circle on the hourly) formed a lower low

(E) and a higher high (

F) in the consolidation. This kind of consolidation pattern is very often followed by a strong wave in the trend direction (down) as many breakout-traders got trapped

(E, F) in the wrong direction, which often fuels the momentum. The small bear flag on the right of the 5 min chart analysis was the respecting of the green trendline in particular and the consolidation (circled) between 2 p.m. and 3 p.m. before price resumes the downward trend.

The

breakout candle 1 at 1 p.m.breached again the weekly pivot point but the breakout did not get confirmed on the 5 min chart (point

D)

Update: The recent downward move started at 8 p.m. after the 61.80 % fib retracement at 1.2712 was respected by the 4-hour candle opening at 4 p.m.. With the beginning of the new 4-hour candle (opening at 8 p.m.) the underlying support zone got weaker (61.80 % fib retracement got already touched) and price broke through it after a nice 3-wave consolidation on the 5 min chart between 7 p.m. and 8 p.m. just before the 8 p.m. 4-hour candle opened..

Trendline break on the 16th of October

EUR/USD confirmed the break of the hourly trendline

The Euro confirmed the break of the hourly resistance at 1.2991 (blue line) and the daily R1 with the beginning of the new hourly/ 4-hour candle at 8 a.m. (Timing Setup). The 100 % Fibonacci extension from the recent swing up (11 - 12th of October) moved to the daily low of October 15th (Yesterday) provided resistance so far at around 1.3057.

The 1 hour Euro Chart analysis below also shows a Butterfly sell pattern, important Fibonacci support and Fibonacci resistance at the 61.80 % and 100 % level.

|

| 1 hour Trendline break confirmation |