Trading the Forex Market Price Manipulation

Index:

Forex Price Rigging and Manipulating Series- Overview of the Forex Price Manipulation:

- Is Forex too big to rig?

- Price Rigging: Forex Market Manipulation analyzed!

- Trading Strategy: How to trade with the FX Price Manipulation

Technical Chart Analysis and Trading Strategies- Support and Resistance levels, Consolidation patterns

- Fibonacci Analysis

- Breakout Trading Strategies

- Important Chart Patterns - Price Rejection, Fibonacci Extension, Continuation Chart Patterns

- Do Popular Chart Patterns work? - Price Manipulation

- High Probability Trading Setup Guide

- Candlestick Chart Patterns

The

Chart Analysis Legend includes the mainly used Chart Reading Patterns, Methods and Tools

My current shorter term trading strategy

Trading strategies and opinions have evolved and partly changed over time and will do so in future.

My current shorter term trading strategy is to read the intention of the Market Manipulators and to focus on their manipulative stop runs and faked mainstream trading signals at striking mainstream price levels like Highs/ Lows, Round Numbers and Pivot Points in the Forex Majors like EUR/USD, GBP/USD.. EUR/GBP as well as in other markets like S&P 500 (SPY), Dow Jones Industrial, DAX...

I currently do not use Fibonacci analysis, trend lines, SMAs or any popular chart patterns. Often these mainstream trading signals are faked signals.

However, for the longer term, it is also very important to analysis the fundamentals of the currencies. I personally like the investment bank reports on http://www.efxnews.com,/ the analysis on zerohedge.com and the fx pulse reports and gic weekly from Morgan Stanley.

Manipulation of Popular Chart Levels

The main message of this website is just below:

Popular Chart Levels are often tacitcally misused for faked Trading Signals and Stop Runs by Manipulators in the short run before the fundamentals regain and the major trends resume.Some Popular Trading Levels:

- Important Highs/ Lows

- Round Numbers

- Pivot Points

Market price often comes back to popular chart levels like Round Numbers / Pivot Points and frequently penetrates them to trigger mainstream trading signals and to run for stops. Particularly, market Highs and Lows are important Manipulation points, where false price breakouts (false first breakout) occur to clear stop loss orders and to trigger breakout limit orders before market reverses back. Be careful with these mainstream trading strategies. Moreover watch out for pure stop runs at these chart levels, which can lead to a strong market turn around. In general, the first price breakout at important chart levels is often a false one.

Often a minor false price breakout or only a price touch of Round Numbers and Pivot Points comes with the first test of these chart levels to trigger close-by breakout orders and stop orders. The retracement to catch some stops of the breakout traders often gives the faked impression that the popular chart level holds as Support/ Resistance, thus encouraging mainstream traders to position accordingly. However, market often goes for a second test of the popular chart levels to clear the stop orders above/ below important chart levels before either retracing back or breaking through the price level targeting the next important mainstream level (stop order and limit order zone).

More in detail, if market price only touches (not really penetrating) the important chart level like Round Numbers and Pivot Points and retraces back then a second test of this market level is likely to catch the stop loss and breakout orders at this support / resistance levels of the traders who already had positioned themselves plus the new traders who interpreted the prior hold of the support/ resistance area as a reason to enter the market.

However, if market price already had penetrated the important support / resistance level to catch most of the stop loss orders and breakout orders before retracing back (failed first breakout) then the chances of a second test of the important chart level would diminish as the

intention of the market manipulators to catch the stop loss orders and breakout orders already got accomplished.Moreover, a clean break through a striking trading level without an immediate price retest is seldom and if so then the chance of a retest in near future is likely to catch stop orders of the breakout traders and to minimize the chance of an

easy trade with a small stop lose at important price levels. Furthermore, the reiterating stop triggering process at striking chart levels would be in favour of a clean breakout to happen more often in the absence of any market price manipulation.

In general, market price goes there where the stop loss and breakout orders are anticipated.Read more: Overview of the Forex Price Manipulation

Below and in the left sidebar: EUR/USD analysis from the pastForex Market Manipulation Analysis

Daily Chart Analysis of the EUR/USD - Stop Hunting

The two orange arrows on the top of the 5 min EURUSD chart below (last chart) show examples for the Stop Hunting- and Market Price Rigging process and it further illustrates the importance of breakout trading strategies. The recurring manipulative Stop hunting strategy in Forex is used by the FX Manipulators to fool breakout traders with the typical failed first breakout. The Market Price Rigging Manipulation via Stop Runs allows the Forex Manipulators to catch the stops of the breakout traders and thus this price rigging strategy most often prevents the typical breakout trader to successfully participate in the true breakout.

Most often at striking price levels, like - highs/ lows/ round numbers/ mainstream Support and Resistance levels -, the market price manipulators enforce the failed first breakout - stop hunting. The Stops of the breakout traders get cleared, who entered the market after their limit orders got triggered through the penetration of the striking level.

Furthermore, many stop loss orders of other traders got also cleared through the slight penetration of the striking chart level. After the price rigging strategy got accomplished and most stops of the breakout traders are already taken out of the market then either the true breakout occurs to catch and clear farther positioned stop loss orders of other traders at the striking level or market reverses to target the opposite striking chart level where many stop loss orders of the fooled breakout traders are located and new breakout traders will try to catch the trend again.

Read More in the Price Rigging and Manipulation Series

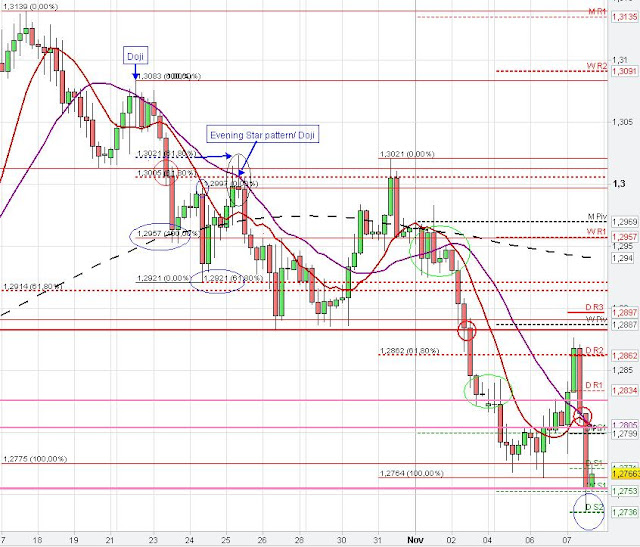

The highlighted Doji candles on the 5 min and on the 1 hour chart could have been used as trading triggers. There are also many continuation chart patterns on the 5 min chart (green circles) and an inverted Head and Shoulders chart pattern on the 4 hour/ 1 hour chart.

|

| 4 hour EUR/USD Chart Analysis/ Patterns |

|

| 1 hour Inverse -Inverted- Head and Shoulders pattern, neckline, Doji |

|

| 5 min Doji candle, Continuation patterns,Pivots |