UsdCad The Journey So Far And What To Expect ~ short term forex trading signals

UsdCad was my favourite currency pair. I have traded almost all the patterns in between for a long time. Its count was so easy for me and at a glance, I saw what price was saying in every move and turn.

At the beginning of this year, I started with a bearish bias though with a long term bullish sentiment. The article was titled UsdCad Analysis for 2015. I forecast a rally in price to 1.35 and above, but after a dip to 1.0 region.

Below is an excerpt from the article.

"In the long term, this current impulsive move from 2011 is probably part of the ‘C’ leg of the projected zigzag corrective pattern. The ‘C’ leg should take us to 1.35xx and 1.46xx in the years to come, probably a period of 3-4 years"

Price since then even rallied further quickly to a long term high in a 5-wave impulsive bullish move which fit a perfect flat formation (weekly chart) as I posted in what was titled Flat formation in Usdcad. I sold at the completion of the flat as I expected a full long term bearish move. Price only dipped for about 900pips before the bullish resurgence.

Price advanced to 1.255 and I labelled it a zigzag correction of the first bearish move which I favoured as an impulsive move though I had a corrective alternative. I chose the impulse because I expected price to react to a larger degree flat pattern..

The advance to 1.255, as a percieved zigzag pattern prompted me to a sell expecting a wave 3 dip which should at least break 1.19 below.

After that discovery, I posted an analysis titled Multi face analysis of Usdcad.

Below is an excerpt from the analysis.

"The long term bullish flat correction which started in 2007 is expected to have ended. The first impulsive wave downside followed by a prospective zigzag corrective wave 2.

Price is expected to start a new impulsive journey to the downside which is expected to take 1.1920 ( the first wave low) and to 1.1250."

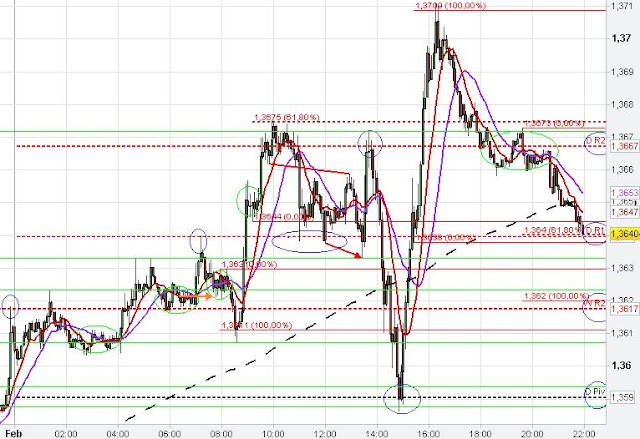

Price dipped as expected in a move that was not typical of a wave 3, a zigzag to be precise. The dip ended at 1.21 which was 200pips away from the 1.19 low. Price advanced so fast in the manner of an impulsive move as I watched it broke above the 2015 high at 1.283 and I changed my wave analysis to what I have below.

So if this is the case, what do we have in the longer term?

The dip from 1.283 to 1.19 was only the 4th wave of the last leg of the longer term (degree) abc correction to complete what pattern?. A zigzag probably.

The chart below shows an emerging long term correction.

This zigzag pattern has entered the region of the 4th wave of the impulsive dip from 1.62 to 0.905 ,as shown in the chart above, which is a good region for the completion of a corrective pattern especially a zigzag.

I expect price to continue the rally to 1.34 or 1.40-46 in a fifth wave journey after a minor shorter term wave 4 dip.

These projected levels are similar to what I forecast at the beginning of the year as I have posted at the beginning of this article.

What happened between January and July, of course, was a change of pattern which is what we use as elliot wave theorist to understand the behaviour of price.

We can follow price actions by analysing with elliot waves theory.

By using elliot wave principles, we can :

1. identify the direction of the dominant trend.

2. identify counter trends.

3. determine the maturity of a trend and a counter trend.

As prices develop, we will look for inherent tradable patterns that will build our confidence and apply the right money management rules.

Trade with confidence. JOIN AN ELLIOT WAVE MENTORSHIP CLASS and be an elite trader.

More info for UsdCad The Journey So Far And What To Expect ~ short term forex trading signals: