Price target Pivots Fibonacci ~ world best forex trading signals

Head and Shoulders neckline

Butterfly sell pattern

Chart pattern Price target

On the daily Chart of the EUR/USD we see a Head and Shoulders Chart pattern. The Euro closed at the brown neckline on the 5th of July and broke through the neckline on the next trading day, which triggered the Head and Shoulders pattern.

A close at Support/ Resistance levels, like the close at the Head and Shoulders neckline (blue circle), often weakens this Support/ Resistance level (see Breakout Trading/ Breakout Timing) so that a break of this S/R level (for a true breakout or a false breakout where price bounces back strongly - Stop Running and fooling breakout traders) is likely.

The target of the Head and Shoulders pattern is often the 100 % Fibonacci Extension level from the price range of the largest swing of the Head and Shoulders formation moved to the neckline break. The smaller 61.80 Fibonacci Extension level also led to a minor price reaction of the EUR/USD.

The EUR/USD bounced from this Head and Shoulders price target and started a strong upward leg after hitting the 100 % Fibonacci Extension price target of this chart pattern.

|

| Daily Head and Shoulder pattern |

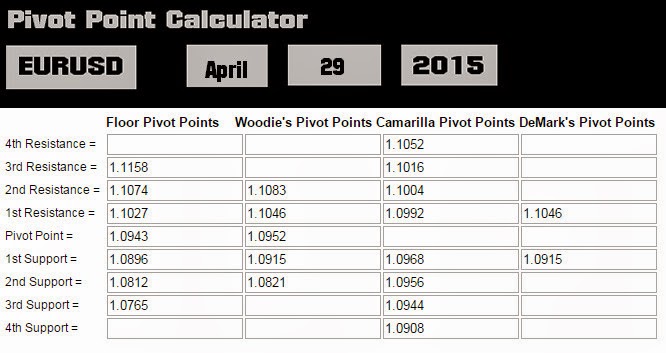

The 4 hour chart below shows that the recent up move in the EUR/USD market found resistance at the monthly S1, which coincided with the daily Resistance (pink line) and the consolidation price zone of the small and tight consolidation chart pattern on the left side of the 4 hour chart below. Hence, the level around the monthly S1 at 1.2388 was likely to lead to a price reaction due to the confluence of different resistance levels.

|

| 4-hour Eur/Usd Chart Analysis |

The 1 hour chart below emphasises the importance of Pivot Point analysis. The daily Pivot at 1.2243 led to a strong upward move and marks the low of todays trading range, whereby the daily R1 and the monthly S1 capped the market price besides the other reasons mentioned above.

The red ellipses show Breakout Timing setups, where market price closed at Support/ resistance before breaking it with the start of the new candle, whereby the blue ellipses are marking price reactions at important Support/ Resistance.

|

| 1-hour Eur/Usd Chart Analysis |

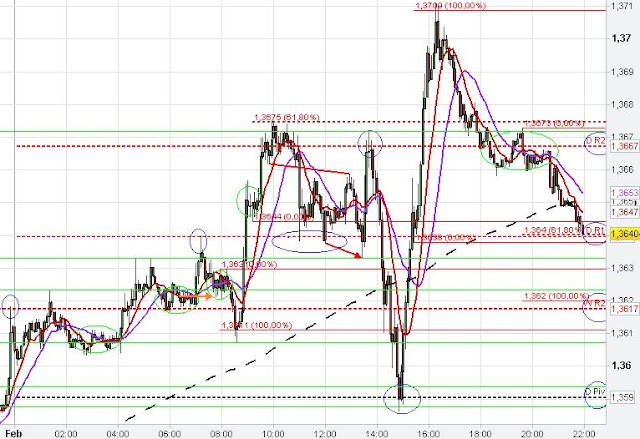

The 5 min Euro Chart shows the importance of the daily Chart level at around 1.2290 where marked price reacted repeatedly. Furthermore, the daily chart level also changed its role between support and resistance repeatedly depending on price action in regards of true/ false price breakouts of this level.

In addition, there is a Butterfly sell pattern on the 5 min EUR/USD chart, which worked out very well. The failed breakout of the consolidation pattern (green circle) to the upside terminated at the monthly S1, which coincided with the 127 % Butterfly level, and price broke through the opposite consolidation boundary with strong momentum.

|

| 5-min Butterfly sell pattern |

More info for Price target Pivots Fibonacci ~ world best forex trading signals: