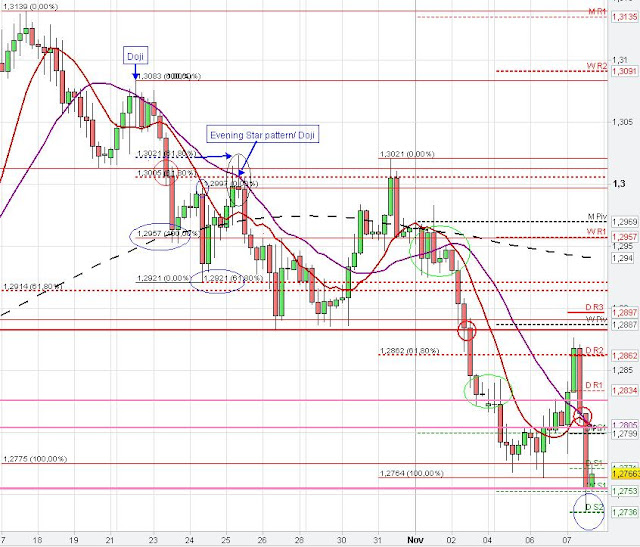

Monthly and Daily Support/ Resistance

Monthly and Daily SR zones

|

| Daily Support Resistance |

|

| Monthly Support Resistance |

On the daily chart we see the importance of the key level at 1.2456 (monthly low of March 2009-purple line).

|

| 1 hour Daily Support Resistance |

|

| 5 min Support Resistance |

The Euro consolidated at the hourly 20 SMA in yesterdays late US session and resumed its up trend in the Asian session. The Euro moved up to the 100 % fib extension (5 min chart). From there, the Euro fell back into the price range of the prior consolidation and the Euro formed a kind of Butterfly pattern on the 5 min chart. Market moved to the 127 % fib extension (target of the butterfly: 127 or 161), which coincided with the 20 SMA on the 4 -hour chart before the Euro bounced back and moved below the low of the butterfly pattern (reversal pattern).

The 5 min chart also shows that the breakout above the recent high at 1.2524 did not get confirmed and market cleared the stops and limit orders above the recent high before the Euro reversed.

The prior consolidation pattern, the pivot point and the 61.80 % fib retracement terminated the retracement up to 1.2515 and market resumed its down trend. However, the Euro found strong support at the monthly low (March 2009) at 1.2456 as well as the daily S1 and weekly S1 and the 5 min breakout candle of yesterdays low (stop fishing-first test) did not get confirmed. The Euro moved up and found some resistance at the hourly 10 and 20 SMA (green circle on hourly chart).

The Euro resumed its downtrend, formed a bear flag and breached the monthly support initially with the beginning of the new 4-hour candle at 4 p.m. after the prior 4-hour candle already touched (respected) the monthly support. However, The Euro could not confirm a break below the monthly support on the 5 min chart and market bounced back from the daily low of June 12th (pink line) and the 100 % fib extension (hourly, 5 min chart).

The Euro moved up from the support level and formed a bull flag on the 5 min chart at about 4:30 p.m.. Furthermore, the hourly candle closing at 5 p.m. shows a strong rejection (pin bar) after the unconfirmed breach of the monthly support level. After the close of the hourly candle at 5 p.m. (confirmation of the strong pin bar) market initially moved up further from the small bull flag and cleared the stops above 1.25 level. The Euro found some resistance above the recent high (stop clearing target reached, 200 SMA on the 5 min chart).

Consolidation price zones (particularly the middle of this zone) very often provide some support/resistance at least for a temporary small bounce when price reaches this price zone again particularly for the first time (however, if one candle closes in the zone (respecting of the level) then the next might move through the consolidation price zone without a bounce (strong trend)). This price behaviour is visible in most of the circled consolidations on the 5 min chart for example the Euro found support at around 10 p.m. GMT, which is likely to be a consequence of the consolidation price zone at around 4 p.m. yesterday. Similarly, the consolidation in the late US session yesterday is likely to be the reason for todays support at this price level.The small consolidation at about 1.30 at the monthly support might not be a good example due to the Timing setup (4.p.m. and the strong tendency of the market to clear stops below highs/lows).